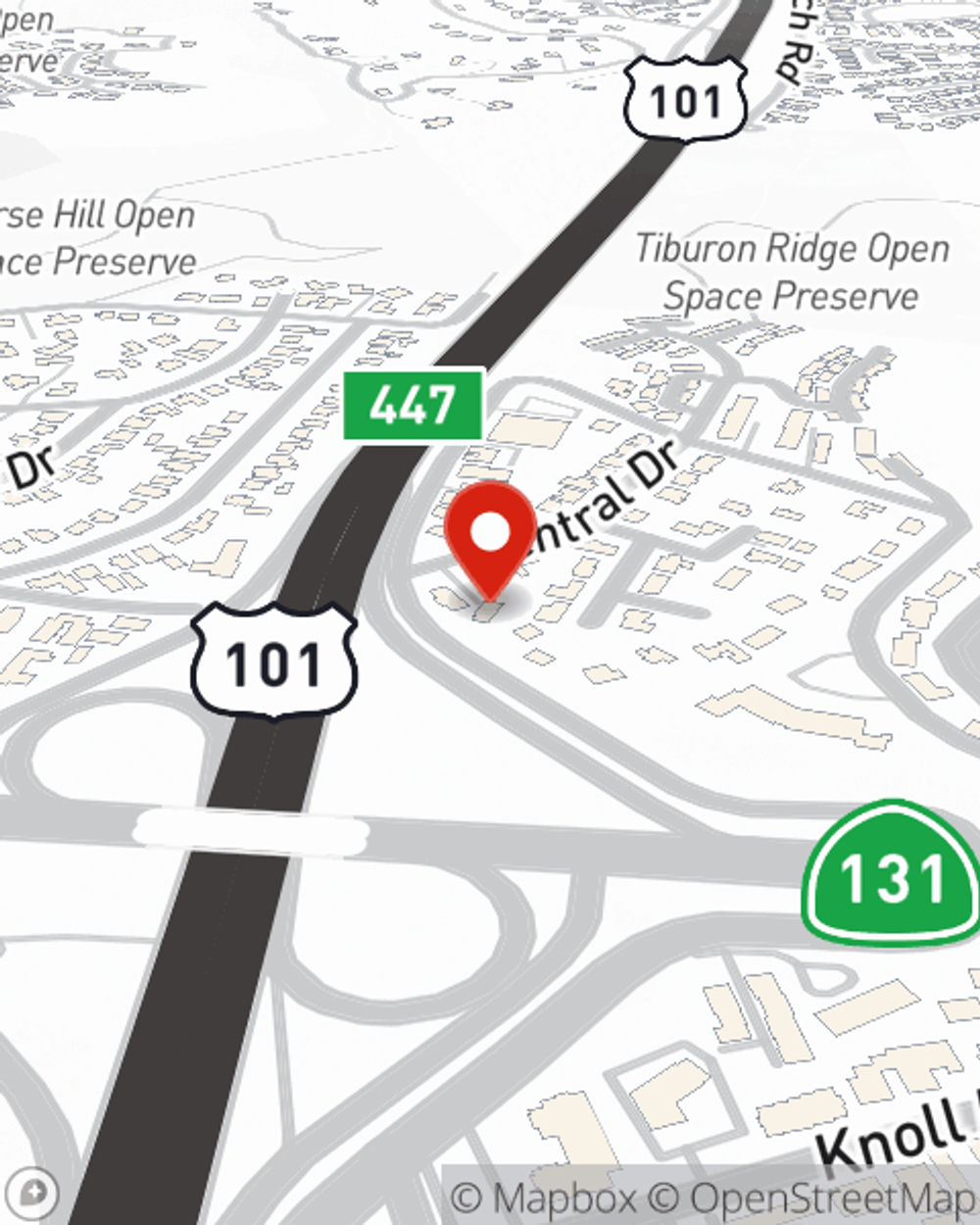

Business Insurance in and around Mill Valley

Calling all small business owners of Mill Valley!

This small business insurance is not risky

This Coverage Is Worth It.

Running a small business comes with a unique set of wins and losses. You shouldn't have to deal with those alone. Aside from just those who care for you, let State Farm be part of your line of support through insurance options including errors and omissions liability, business continuity plans and worker's compensation for your employees, among others.

Calling all small business owners of Mill Valley!

This small business insurance is not risky

Insurance Designed For Small Business

When you've put so much personal interest in a small business like yours, whether it's a drug store, a pizza parlor, or an antique store, having the right protection for you is important. As a business owner, as well, State Farm agent Cesar Flores understands and is happy to offer personalized insurance options to fit what you need.

Call Cesar Flores today, and let's get down to business.

Simple Insights®

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

Cesar Flores

State Farm® Insurance AgentSimple Insights®

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.