Life Insurance in and around Mill Valley

State Farm can help insure you and your loved ones

Life won't wait. Neither should you.

Would you like to create a personalized life quote?

State Farm Offers Life Insurance Options, Too

People decide to get life insurance for a variety of reasons, but the main purpose is usually the same: to ensure the financial future for your loved ones after you're gone.

State Farm can help insure you and your loved ones

Life won't wait. Neither should you.

Life Insurance You Can Trust

Personalized service is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If the worst comes to pass, Cesar Flores is committed to helping process the death benefit with care and consideration. State Farm has you and your loved ones covered.

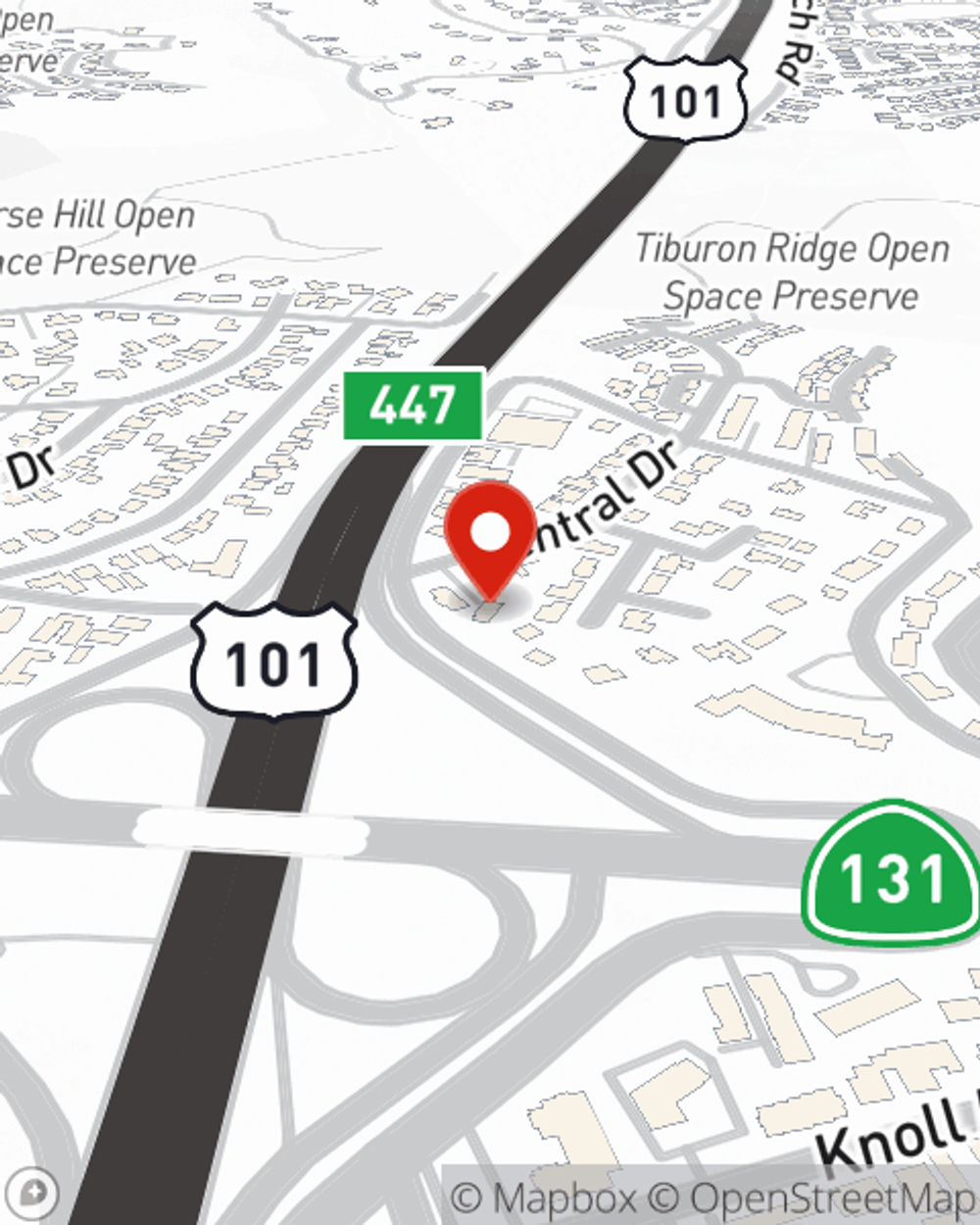

Get in touch with State Farm Agent Cesar Flores today to discover how the leading provider of life insurance can help you rest easy here in Mill Valley, CA.

Have More Questions About Life Insurance?

Call Cesar at (415) 381-6502 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Can you really save if you choose to bundle insurance?

Can you really save if you choose to bundle insurance?

Bundling insurance, such as auto and home insurance, can be a great way get discounts — but that’s not all! We share some insights about why bundling makes sense for savings and more.

Whole Life insurance

Whole Life insurance

What is the difference between Ordinary life and Limited-payment life? Read about some common uses for Whole Life Insurance.

Cesar Flores

State Farm® Insurance AgentSimple Insights®

Can you really save if you choose to bundle insurance?

Can you really save if you choose to bundle insurance?

Bundling insurance, such as auto and home insurance, can be a great way get discounts — but that’s not all! We share some insights about why bundling makes sense for savings and more.

Whole Life insurance

Whole Life insurance

What is the difference between Ordinary life and Limited-payment life? Read about some common uses for Whole Life Insurance.